TD Power Systems: Riding the Current of the AI-Powered Energy Wave

In the early days of India’s industrial emergence, there were companies that built steel, companies that built bridges, and a rare few that quietly powered the rest. TD Power Systems (TDPS) is one of them. Not in the headlines, but in the heart of it all.

1. Company History and Promoters

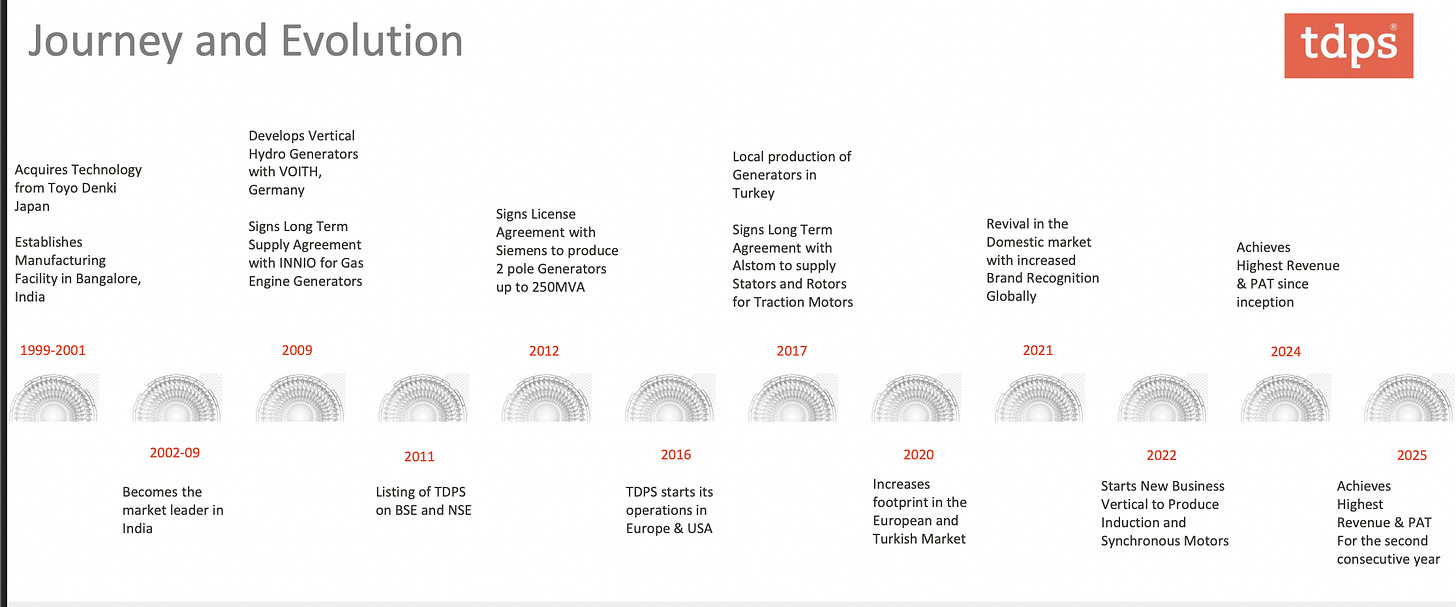

TD Power Systems began its journey in 1999, incubated through a technology transfer from Japan’s Toyo Denki. While most Indian engineering firms of the era were struggling to break out of commodity manufacturing, TDPS chose a different path: highly customised, engineered-to-order AC generators and motors. The founders, Chairman Mohib Khericha and Managing Director Nikhil Kumar, have been instrumental in shaping the company’s strategy from inception. They remain deeply involved, collectively holding over a third of the company’s equity.

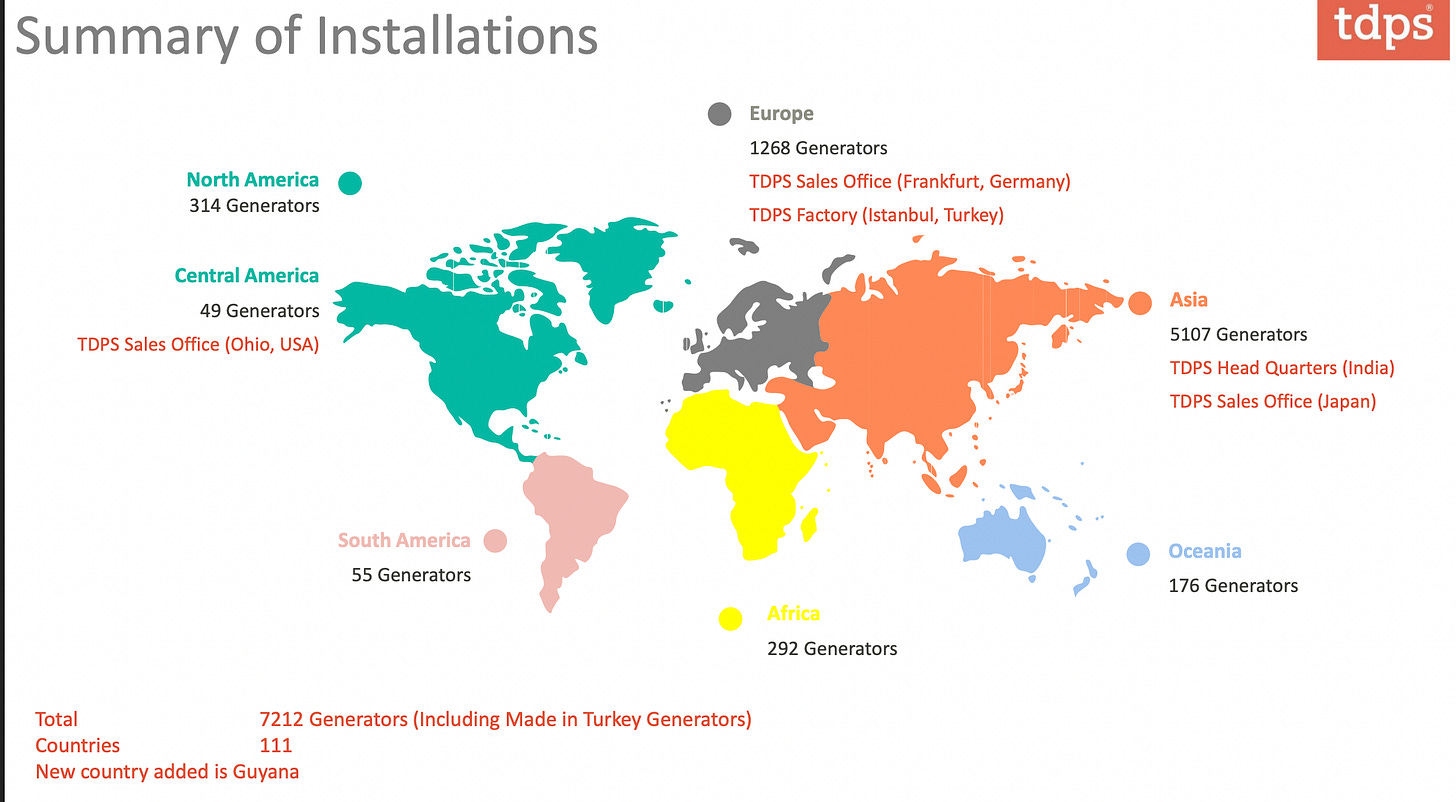

Today, TDPS is no longer a niche player. It exports to over 100 countries, with over 42 gigawatts of installed generation capacity spread across 6,300 installations worldwide. Its journey from a tech-transfer dependent manufacturer to a globally competitive, R&D-focused firm has been steady, under-the-radar, and incredibly strategic.

2. Company’s Offerings and Services

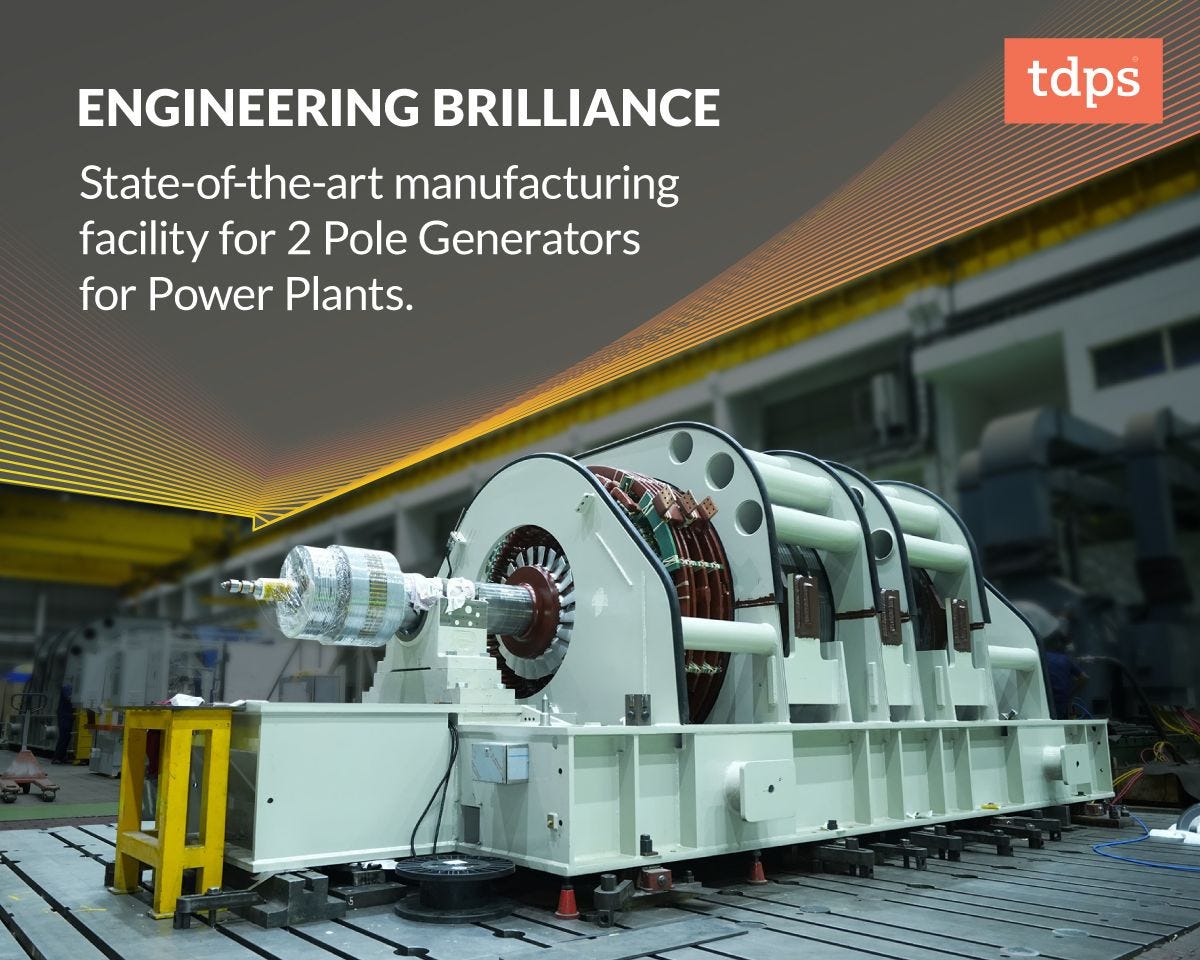

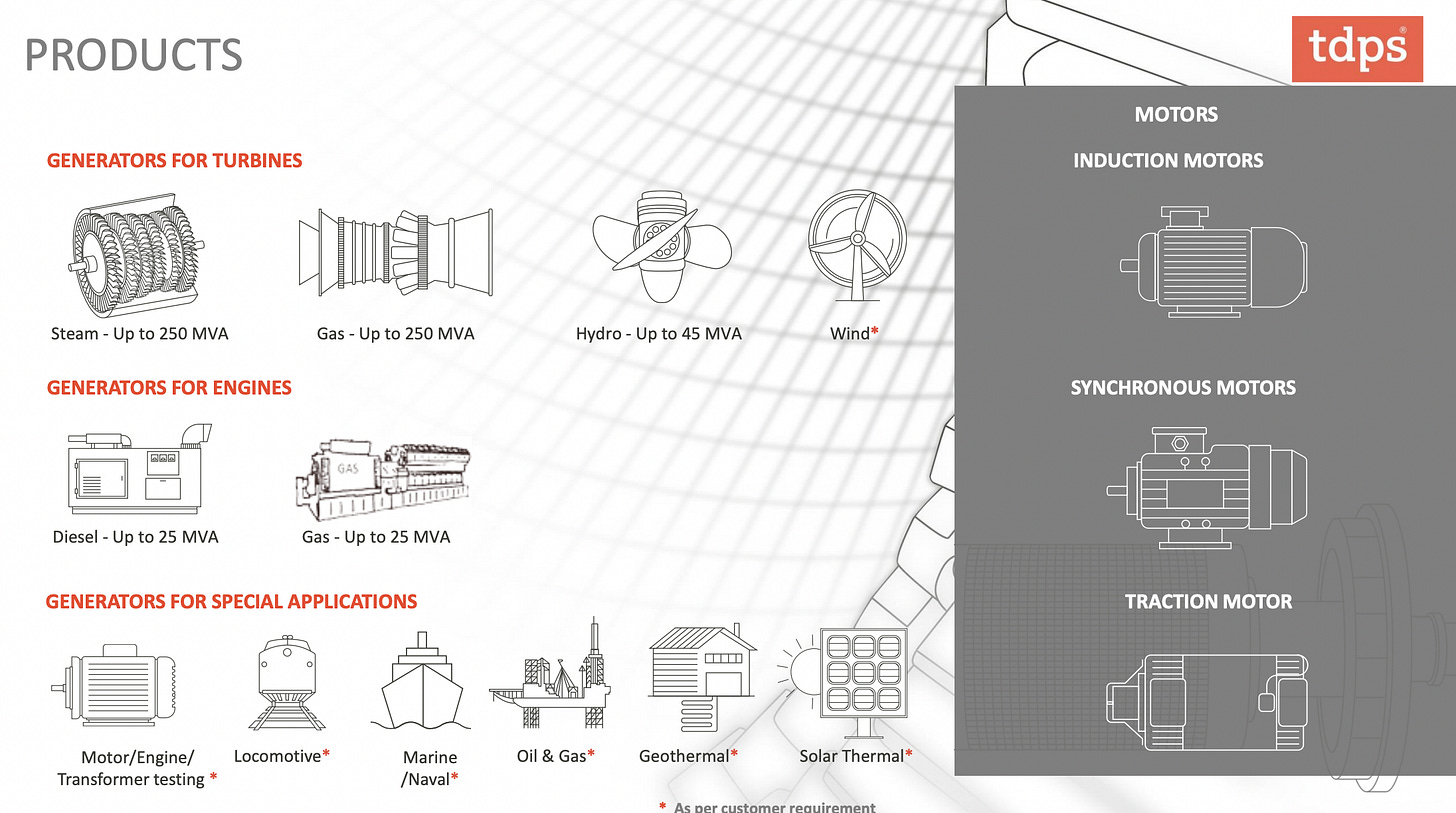

TDPS designs and manufactures large AC generators up to 200 MW across applications: steam turbines, gas turbines, hydro turbines, gas and diesel engines, and even wind turbines. These are the workhorses that convert mechanical energy into electricity in power plants, industrial boilers, cogeneration plants, and data centres.

It also builds traction motors for railways, synchronous and induction motors for industrial use, and offers spares, refurbishment, and servicing via 50+ global service centres. What makes TDPS stand out is its ability to build for extreme environments and customised specifications. It is not a standard genset maker. It is a solution provider for demanding applications.

Its customer base ranges from global OEMs like Voith and Siemens to Indian infrastructure giants and EPC contractors. TDPS doesn’t just supply equipment. It integrates deeply into the supply chain of power plant developers and operators.

3. Past Performance

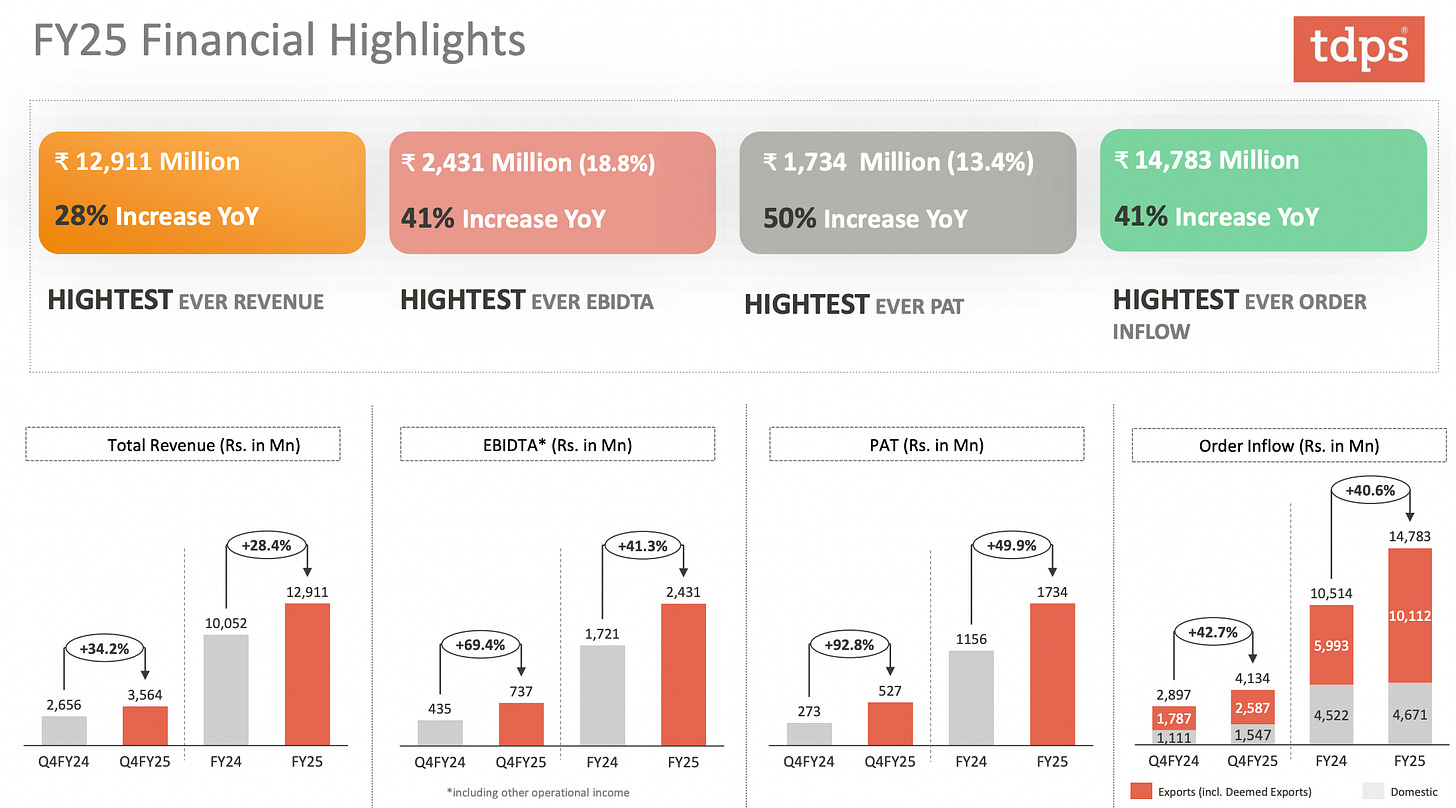

The company has quietly delivered blockbuster results. Revenues have grown from Rs 798 crore in FY22 to Rs 1,278 crore in FY25. Profits have surged even faster, from Rs 70 crore to Rs 175 crore during the same period.

Its EBITDA margins are now north of 20 percent, with return ratios in the mid-20s. In a sector where volatility is the norm and working capital cycles stretch endlessly, TDPS has maintained a near-debt-free balance sheet and cash reserves upwards of Rs 230 crore. That’s not just prudent; that’s masterful capital allocation.

4. Competition

TDPS competes with multinational behemoths like GE Vernova, Mitsubishi, Andritz, and Siemens in large turbine-generator packages. But the space TDPS plays in — customised, mid-sized generator sets — often flies under their radar.

In India, it has smaller, more price-sensitive competition like Kirloskar Electric or Cummins, who mostly make under-5 MW units. TDPS, on the other hand, dominates the space between the global giants and local players. It partners with turbine OEMs or EPCs rather than trying to compete with them. It’s a co-creator, not a challenger.

5. Growth Triggers and Tailwinds

Here’s where the story becomes incredibly compelling.

In its latest investor call, TDPS’s management laid out a vision where the company is seeing robust traction from data centres, AI server farms, fracking operations, and grid stabilisation projects. All of these require stable, responsive, and high-efficiency power solutions. This, in turn, is driving a huge uptick in demand for the kind of generators TDPS excels at building.

Let’s take data centres as the sharpest example. The AI revolution is a power guzzler. A single large AI data centre can consume as much electricity as a small town. According to Goldman Sachs Research, global power demand from data centres is expected to grow 165 percent by 2030, largely driven by AI workloads.

And guess what supports these massive data centres when grids falter? Gas engine-based generators. Quick to start, reliable, scalable. That’s TDPS’s sweet spot. The company has already begun receiving export orders for such generators from the U.S., directly catering to AI data centre expansions.

Add to this the macro energy landscape in India: power demand is surging, peaking at 250 GW in FY25. Thermal and gas-based peaking plants are coming back into vogue. Cogeneration in industries like cement, steel, and sugar is growing. Railways are electrifying at scale, and TDPS’s traction motors find strong relevance here too.

Over 65 percent of TDPS’s revenue now comes from exports. This de-risks its dependence on any one geography and gives it leverage to tap into the global infrastructure and energy upcycle.

6. Valuations

TDPS is not cheap. It trades at around 42 times FY25 earnings and over 10 times book. These are frothy levels for a capital goods company. But consider this: it has a clean balance sheet, a 25 percent return on capital, a 20 percent EBITDA margin, and earnings compounding at over 30 percent CAGR.

It also just raised guidance for FY26 to Rs 1,500 crore in revenues. There is no debt, no dilution, and its new Rs 140 crore capex is entirely funded from internal accruals. This is not a growth story financed by hope. It’s one powered by execution.

7. Risks

Every power story comes with its outages. TDPS is exposed to cyclicality in capital goods demand. Large orders can be lumpy. Raw material costs (like copper and electrical steel) can squeeze margins. Customer concentration exists. If a few OEMs pause ordering, revenue takes a hit.

Moreover, the data centre-AI thesis, while powerful, is still evolving. Project execution delays or shifts in energy policy (especially in developed markets) could affect order inflows. And with 65 percent of revenue from exports, currency risk and geopolitical issues are real.

But these risks are not new. TDPS has navigated them for 25 years. What’s new is the inflection point: energy demand from AI is exploding, and the world needs rapid, reliable, decentralised power. TDPS, without any fanfare, is already powering this shift.

In closing: TD Power is not just another industrial stock. It is a quiet proxy to the AI boom, to data centre proliferation, and to the broader transformation in how we generate and manage electricity. It’s a pick-and-shovel business in an arms race for energy.

Sometimes, the companies that change the world aren’t the ones making the headlines. They’re the ones making the machines that make the world run.